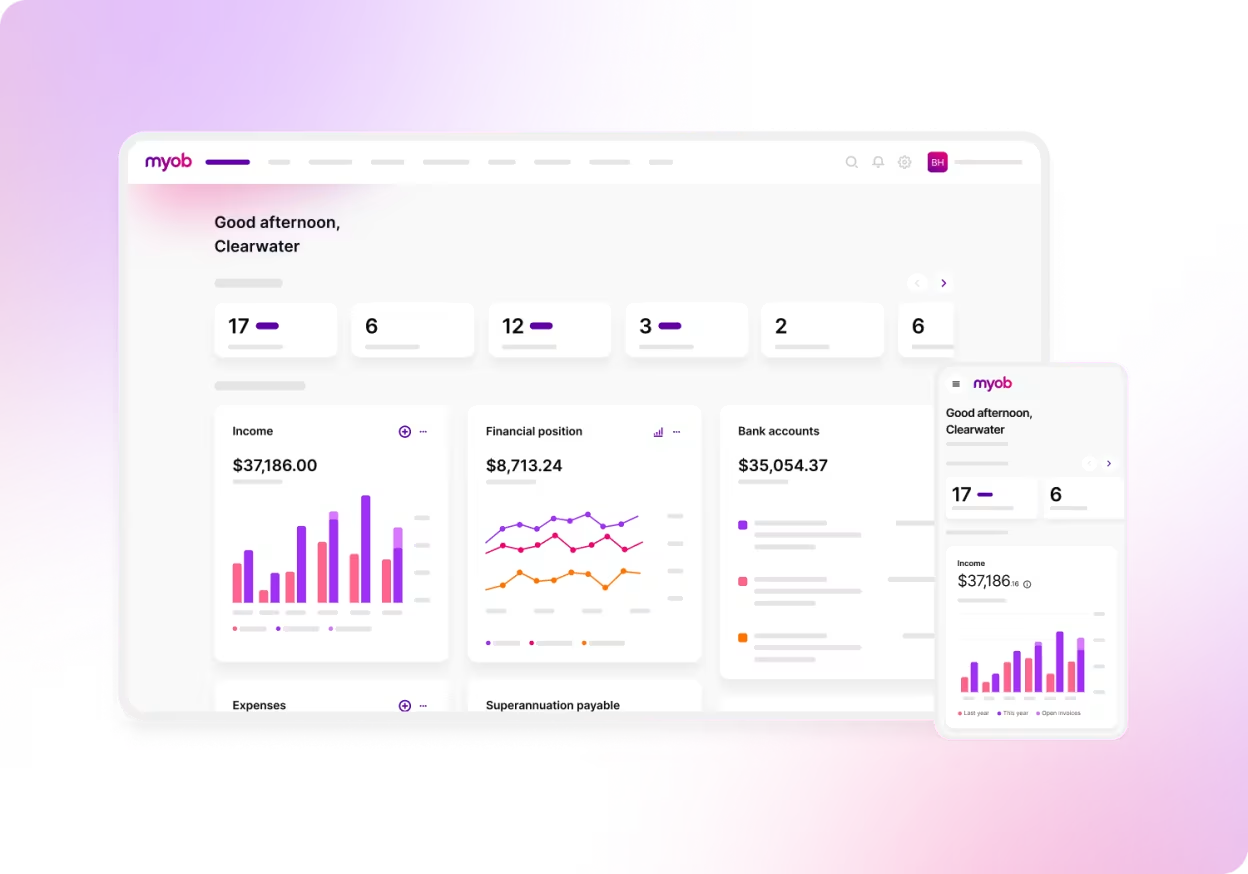

I want my clients to

get paid

Help your clients get paid and manage everything from sales to invoicing and taking payments, all from one place in MYOB Business.

Move your clients to next generation MYOB Business and help them get paid

MYOB helps your clients take care of their customers, supply chain, employees, projects, finances, accounting and tax workflows. All the tasks that matter, managed all in one place.

It’s unmatched by anything else in market and it's built for Australian businesses.

50% of businesses lose precious time to manual tasks.*

Invoicing, chasing payments and running payroll doesn't have to be like this.

Share these five great ways to get paid with your clients:

On-the-go invoicing with the all-new MYOB Assist app

Whether you are on site, on the road, or off the clock, create, save and send invoices the moment a job's done - faster payment and less bad debt means better cashflow.

Plus, with MYOB Assist, snap receipts, upload and let MYOB handle the rest.

Perfect for MYOB Business Lite and Pro, and AccountRight Standard, Plus and Premier (online files).

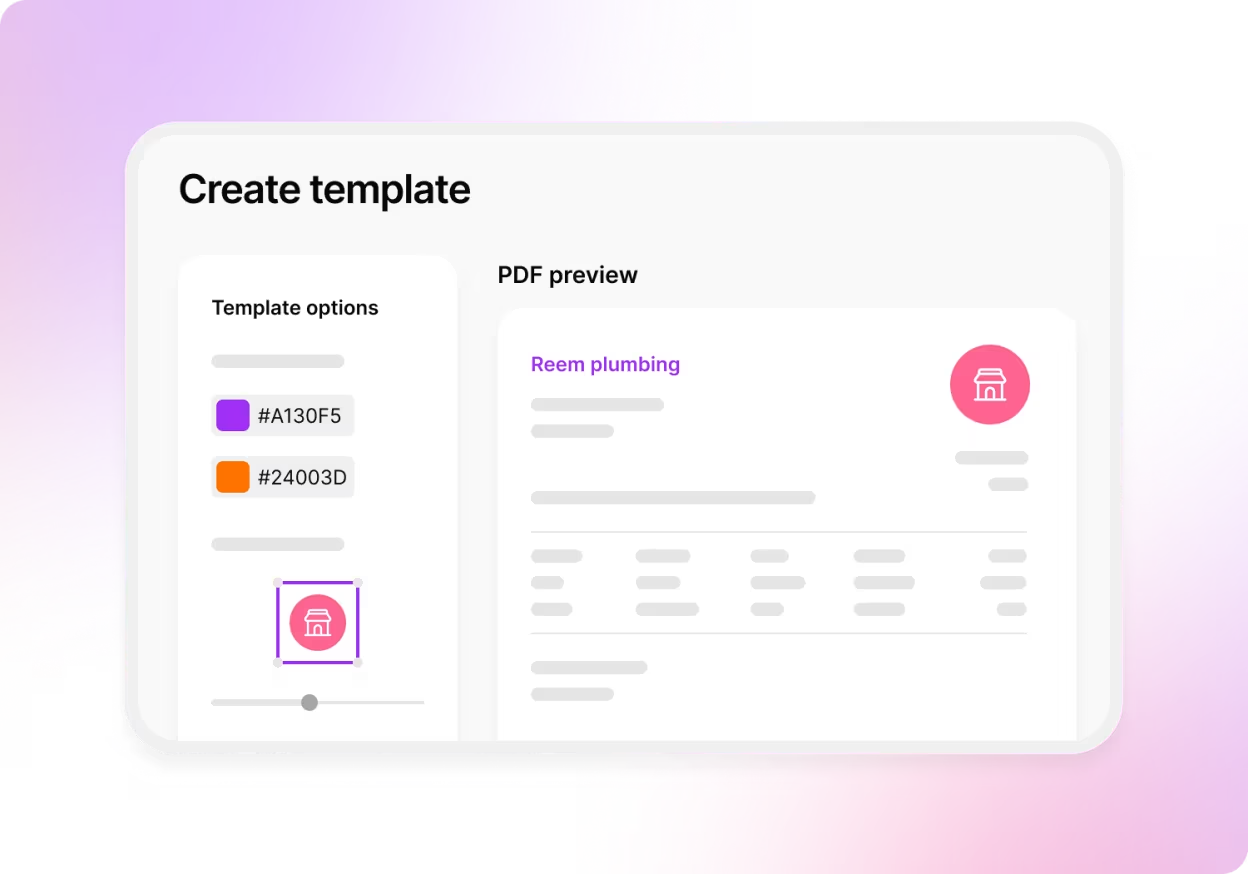

From the first quote to the final invoice

Remove the double-handling when managing sales. Easily create and track quotes, sales orders, invoices and returns all in one place.

Customise templates and save frequently used info to replicate, duplicate and convert anytime.

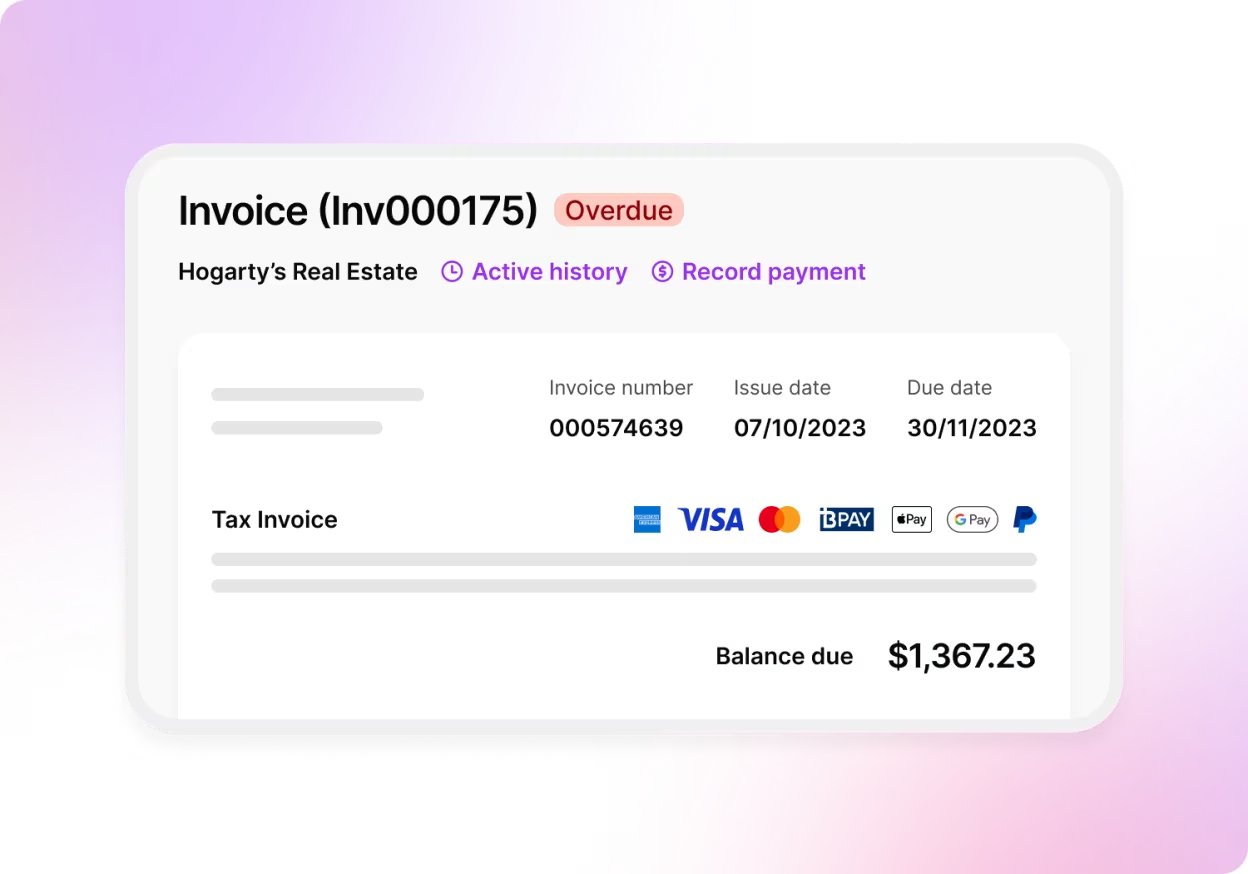

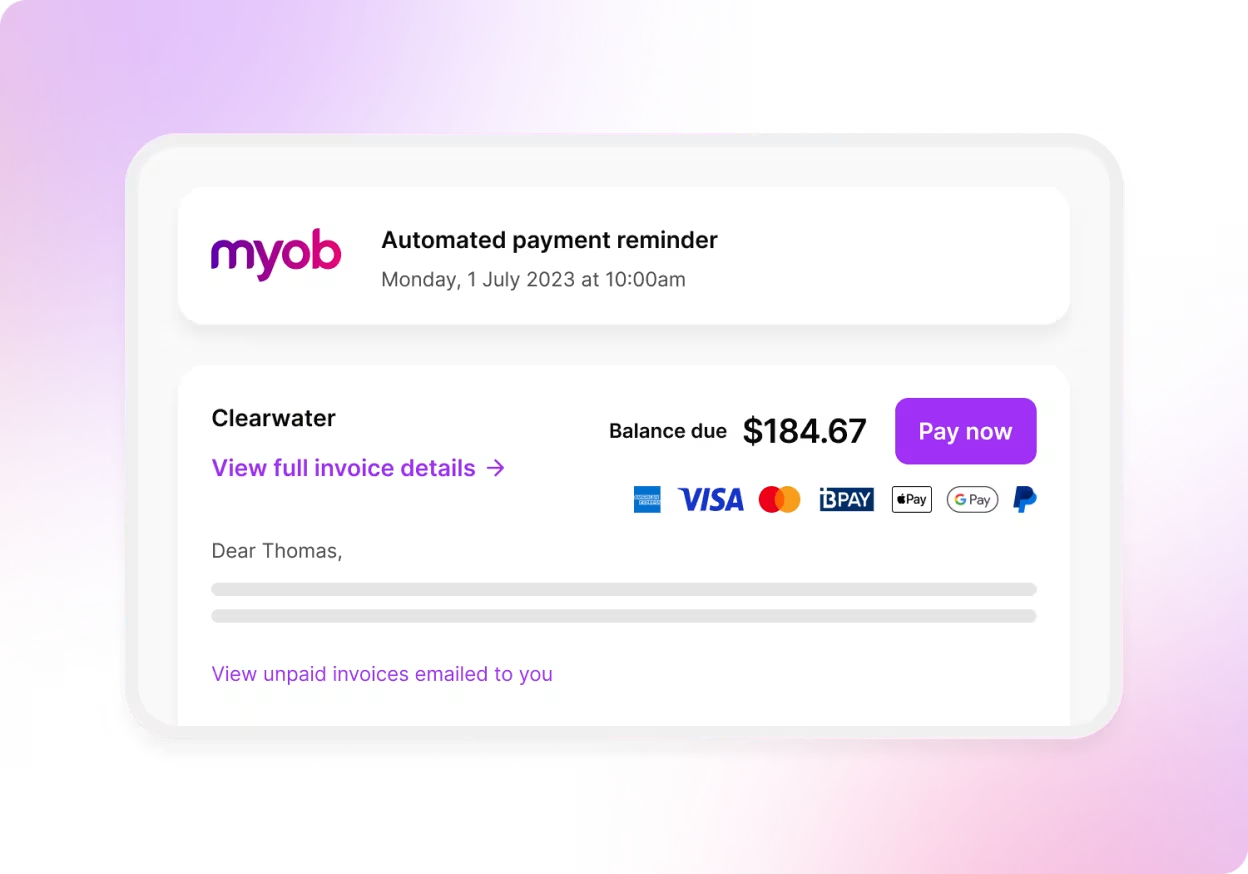

Get customers paying faster with online payments

With the 'Pay now' button on your invoice, customers can pay securely online in a flash.

They’ve got convenient payment options including AMEX,

Apple Pay™, BPAY, Google Pay™, Mastercard, PayPal and Visa.^

Set reminders and keep cash flowing

Spot the paying champs and those who need a nudge with tracking and automatic payment reminders.

Don’t be caught out by late payers! With invoice financing unlock funds from unpaid invoices and keep your cash flowing.

No missed expenses with job cost tracking

Stay on top of job costs by assigning expenses to projects as you go. When the job’s finished, simply import these costs to your invoices, review and hit 'send'.

Help your clients get paid with cashflow done better

Have a cashflow conversation with your clients so they can take control.

Move your clients to MYOB from Xero, QuickBooks, or Reckon

Moving clients’ data to MYOB Business is quick, easy, and subsidised by MYOB to make your decision even easier.

*The Digital Disconnection Challenge | MYOB Report June 2022

The MYOB Disconnection research was conducted by SoWhat Market Research from 24th March and 17th April 2022. A nationally representative sample of 2,056 sole traders, small and medium sized businesses across Australia and New Zealand took part in the survey (1,531 in Australia; 525 in New Zealand). View report.

^Applications for online payments are subject to approval. Fees apply: $0.25 per transaction + 1.8% of total invoice. Fees are inclusive of GST and will be automatically passed on to your customers unless you turn off surcharging. Payment accepted via Visa, Mastercard, AMEX, Apple Pay™, Google Pay™ and PayPal. You can also choose to enable BPAY but cannot pass on a surcharge to customers who pay via BPAY. View terms and conditions here.