I want my clients to

move to MYOB

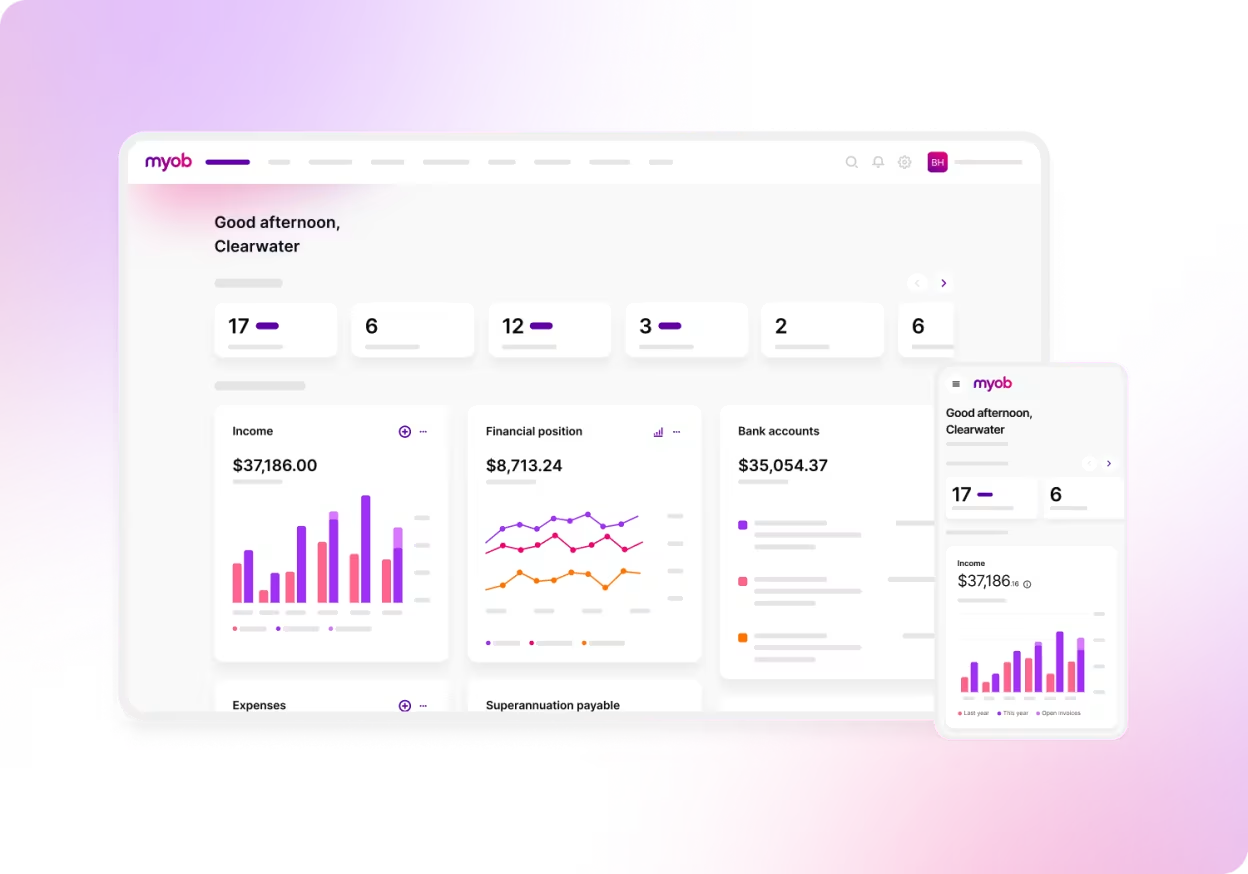

Move your clients from old-school to MYOB and experience a new level of simplicity and productivity in your practice.

Move your clients' jumbled paperwork, spreadsheets and old desktop accounting to next-generation MYOB

From finance and supply chain, to projects, accounting and tax, and employee and project management,

MYOB Business files are effortlessly connected to your practice saving you (and your clients) time and money.

It's unmatched by anything else in market and it's built for Australian businesses.

2 in 5 businesses have to duplicate tasks because of disconnected systems.*

It's time your clients get the right tools to help them grow.

Share these three great reasons to move to MYOB with your clients:

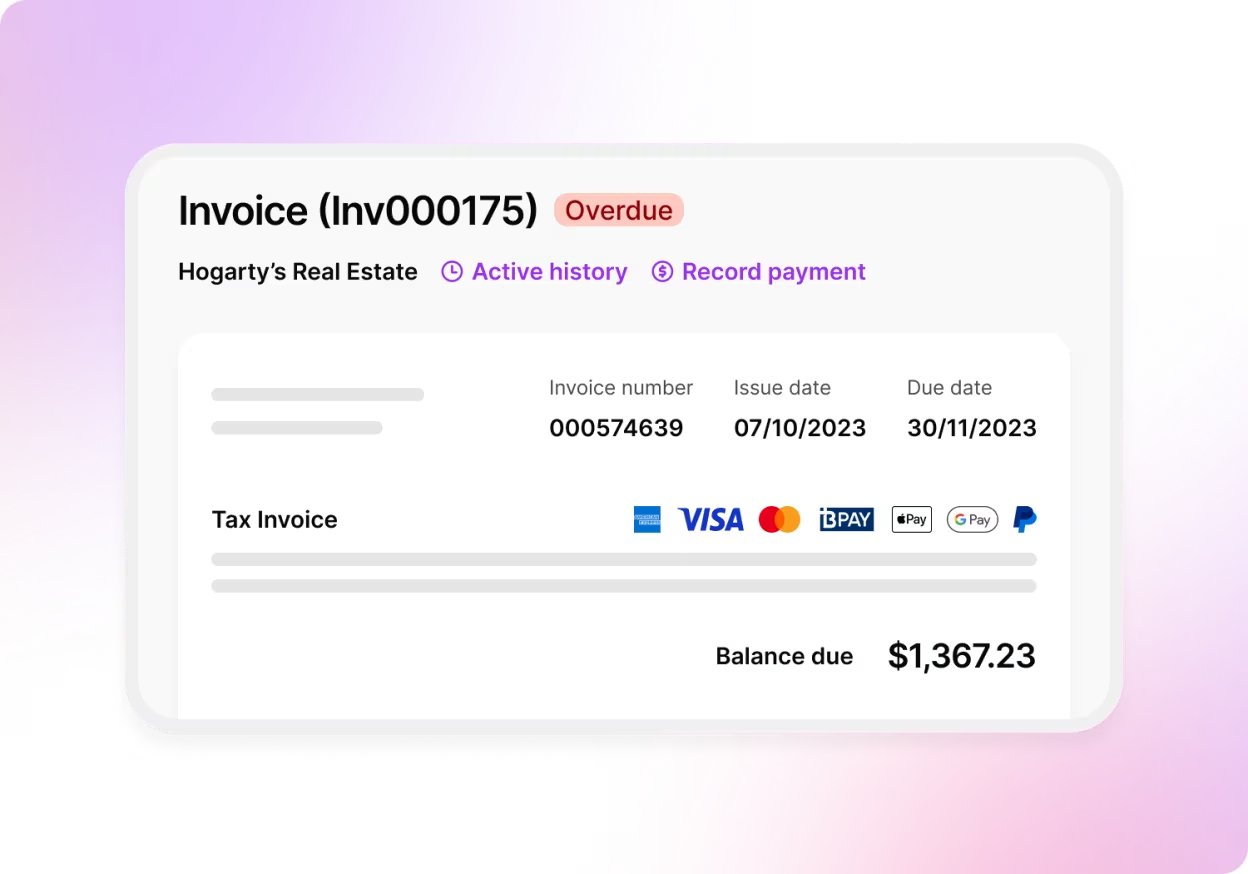

Get customers paying faster with online payments

With the 'Pay now' button on your invoice, customers can pay securely online in a flash.

They’ve got convenient payment options including AMEX,

Apple Pay™, BPAY, Google Pay™, Mastercard, PayPal and Visa.^

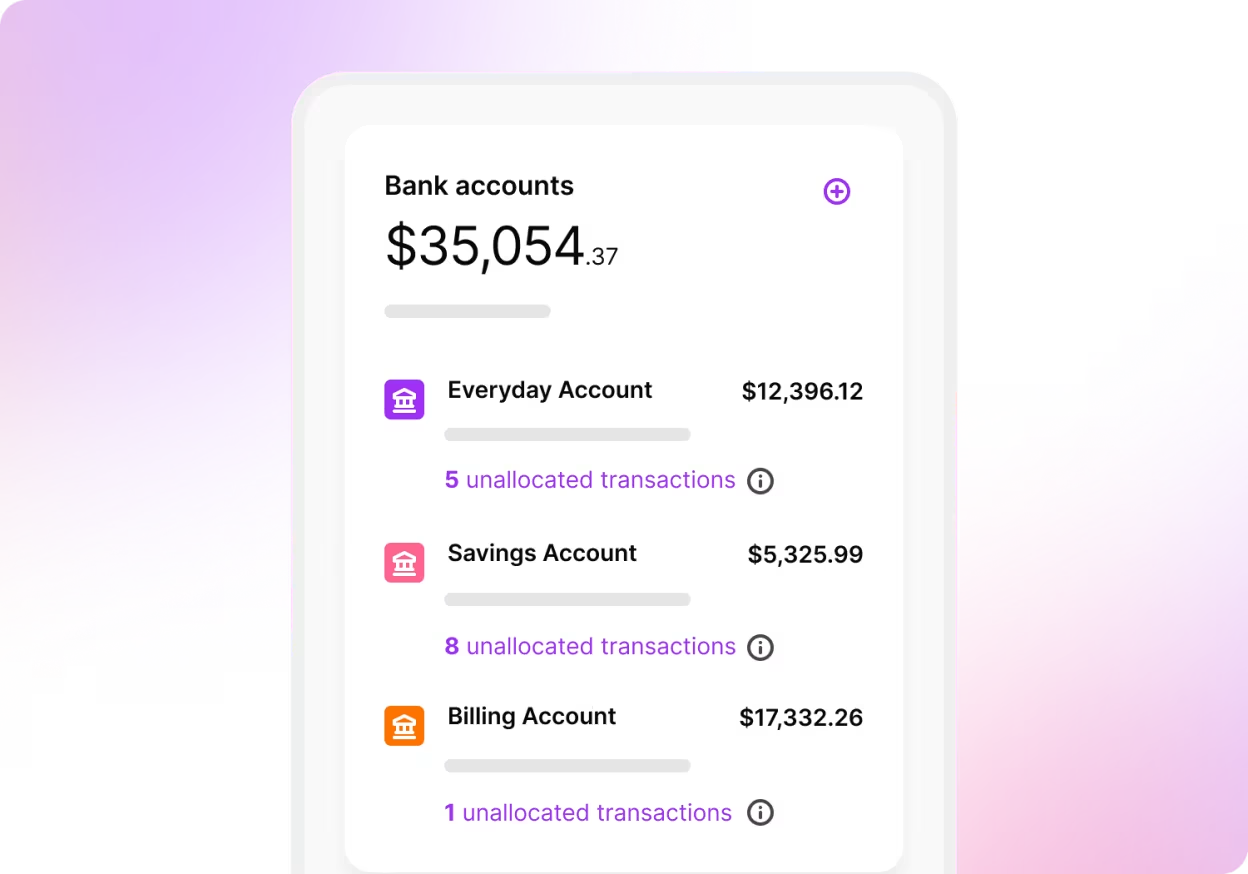

Never miss a dollar or a cent

Use our secure datalinks with 130+ banks, financial institutions and credit card providers so you can make sure every incoming and outgoing is accounted for.

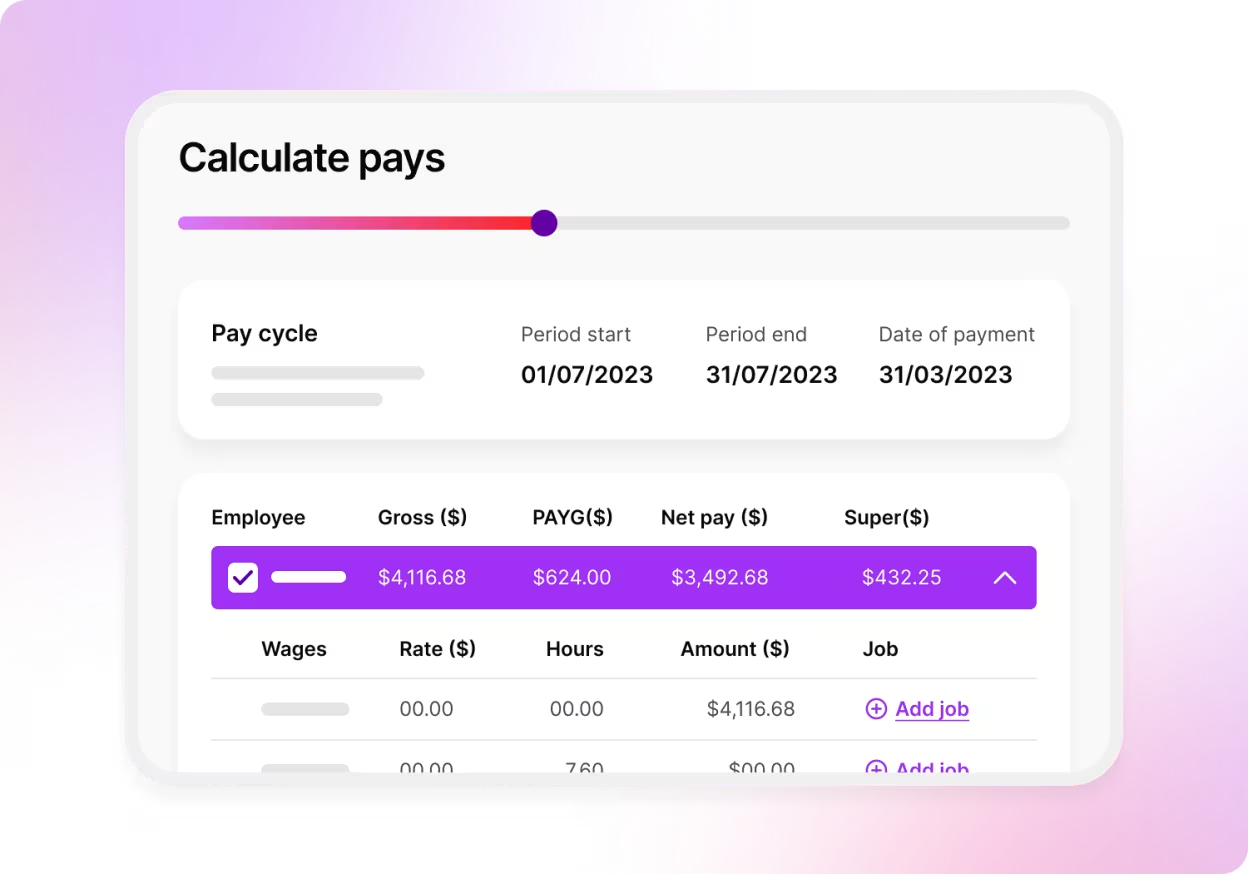

Be confident in your payroll calculations

From shifting award rates to loading entitlements, we’ll ensure your payroll is accurate. MYOB calculates superannuation, tax and annual leave and will alert you if anything needs your attention.

Move your clients to MYOB from Xero, Reckon or QuickBooks

Moving clients’ data to MYOB Business is quick, easy, and subsidised by MYOB to make your decision even easier.

*The Digital Disconnection Challenge | MYOB Report June 2022. The MYOB Disconnection research was conducted by SoWhat Market Research from 24th March and 17th April 2022. A nationally representative sample of 2,056 sole traders, small and medium sized businesses across Australia and New Zealand took part in the survey (1,531 in Australia; 525 in New Zealand). View report.

^Applications for online payments are subject to approval. Fees apply: $0.25 per transaction + 1.8% of total invoice. Fees are inclusive of GST and will be automatically passed on to your customers unless you turn off surcharging. Payment accepted via Visa, Mastercard, AMEX, Apple Pay™, Google Pay™ and PayPal. You can also choose to enable BPAY but cannot pass on a surcharge to customers who pay via BPAY. View terms and conditions here.