I want my clients to

get time back

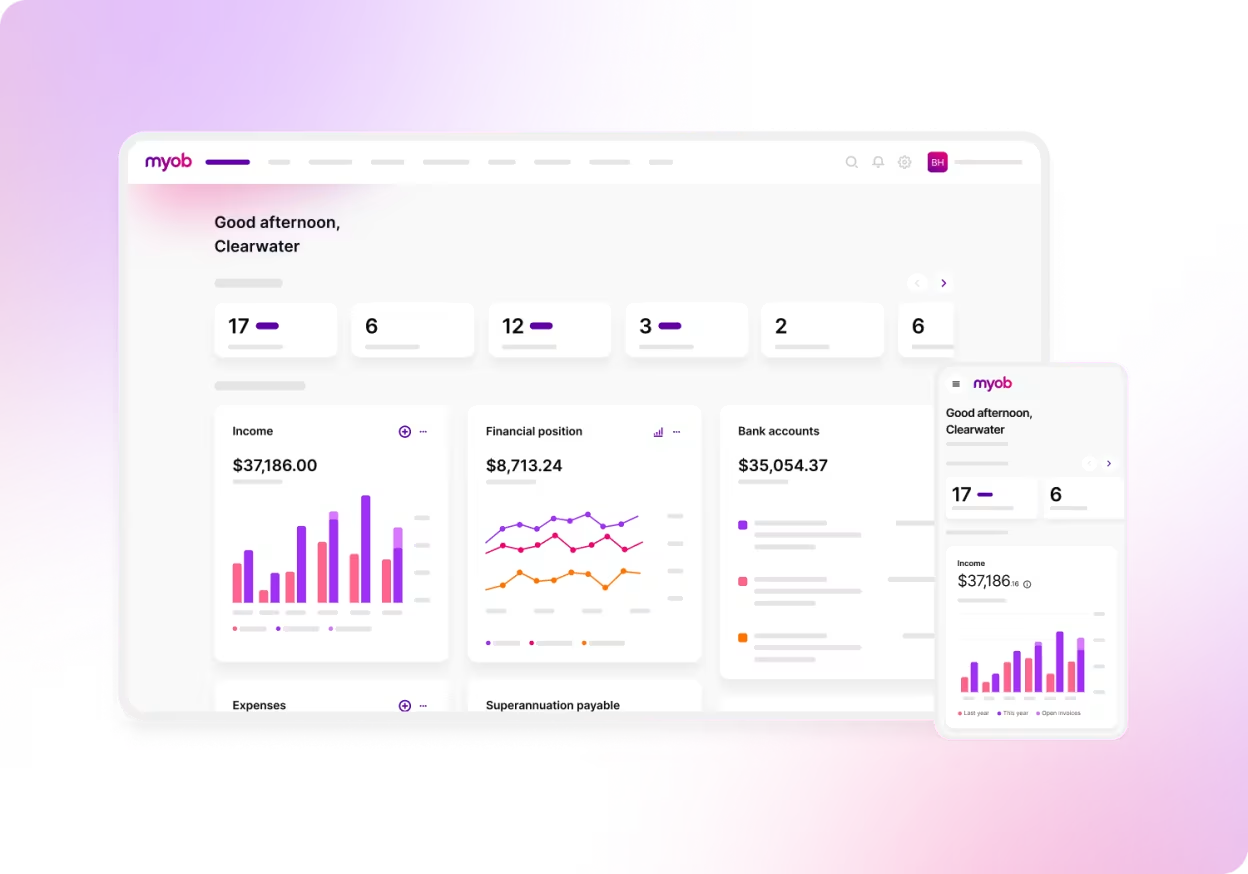

Help your clients grow their businesses on the go with all the tools they need in one place.

Move your clients to next generation MYOB Business and help them get time back

MYOB helps your clients take care of their customers, supply chain, employees, projects, finances, accounting and tax workflows. All the tasks that matter, managed all in one place.

It’s unmatched by anything else in market and it's built for Australian businesses.

Businesses lose 1 entire day every week because of disconnected digital systems.*

Let’s get your clients that time back.

Share these four great ways to get time back with your clients:

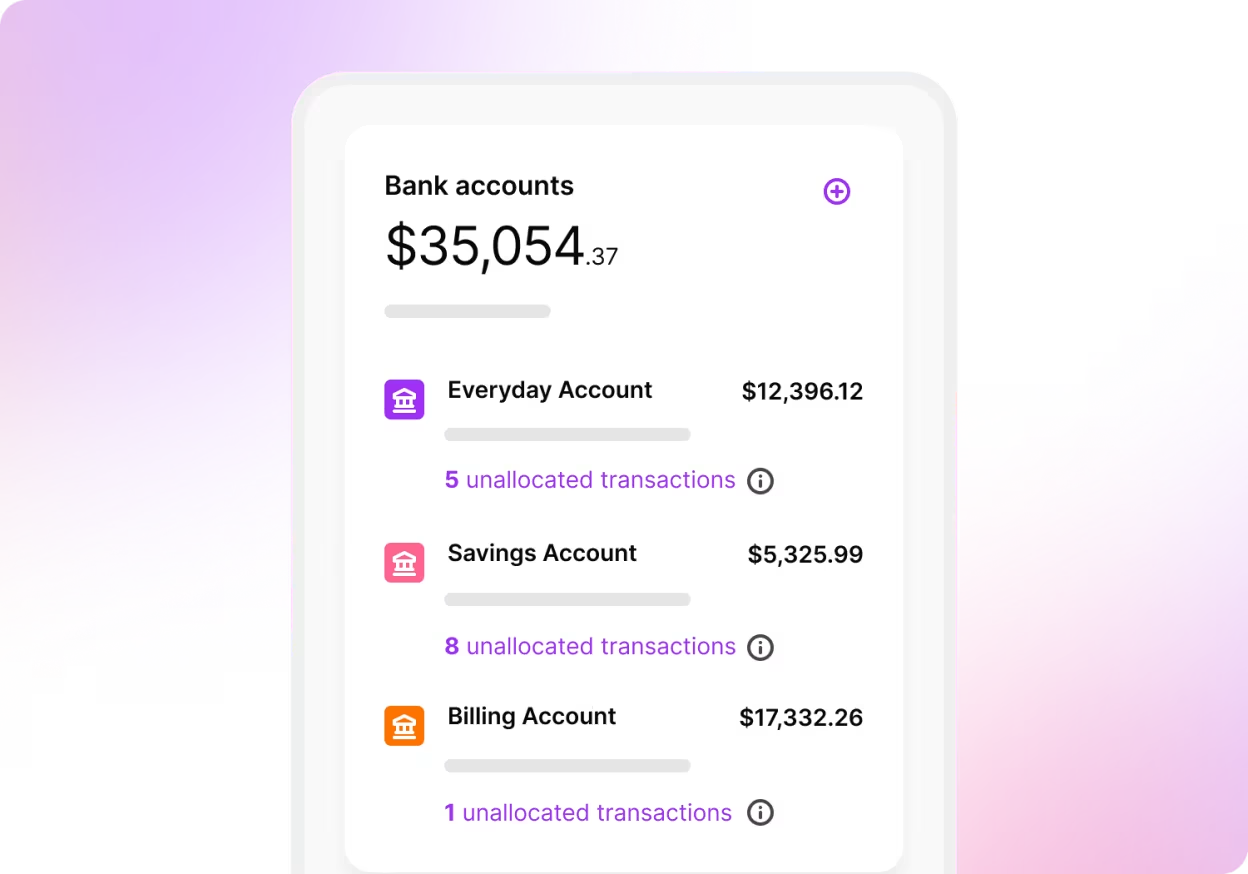

Never miss a dollar or a cent

Use our secure datalinks with 130+ banks, financial institutions and credit card providers so you can make sure every incoming and outgoing is accounted for.

Stay flexible in the cloud

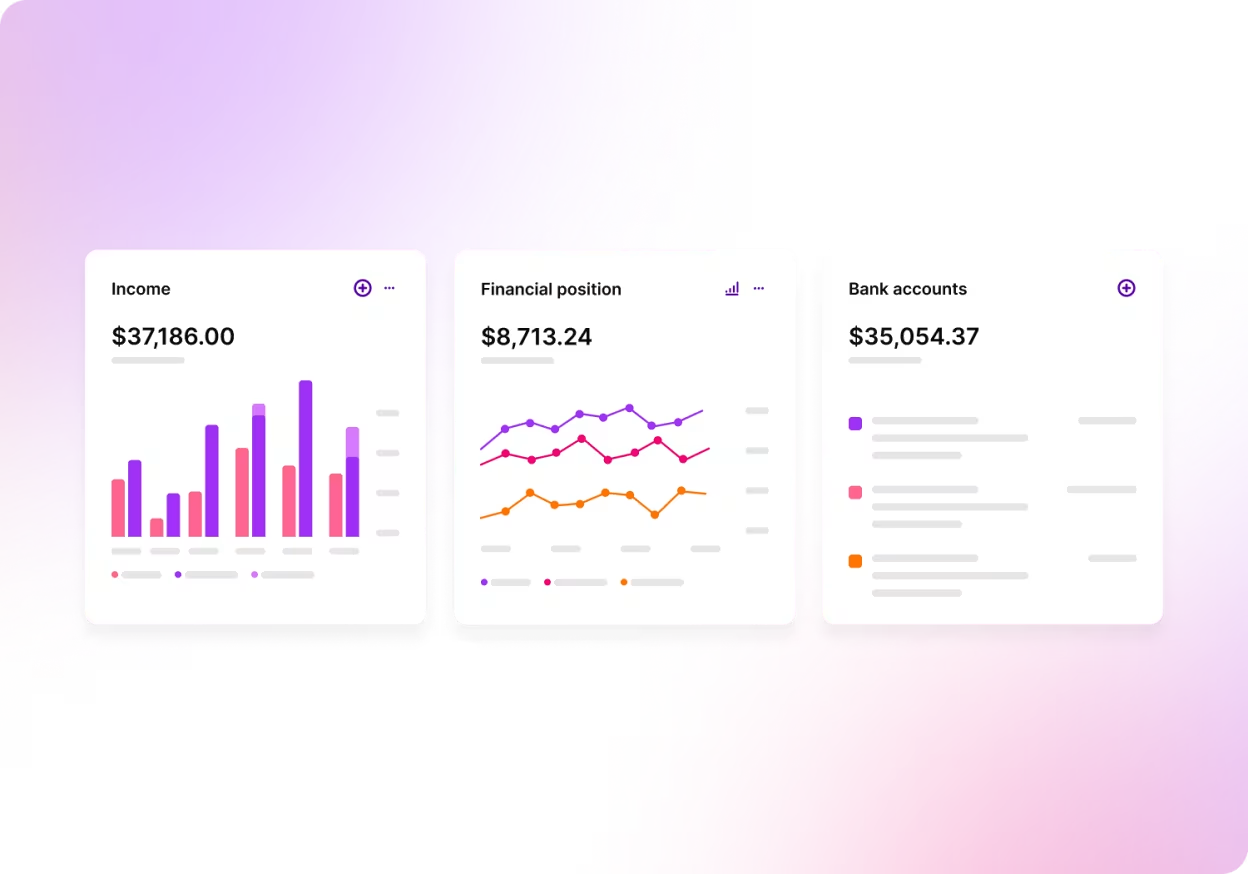

Get the information you need to run your business with a secure, cloud-based management platform that you can run on any device.

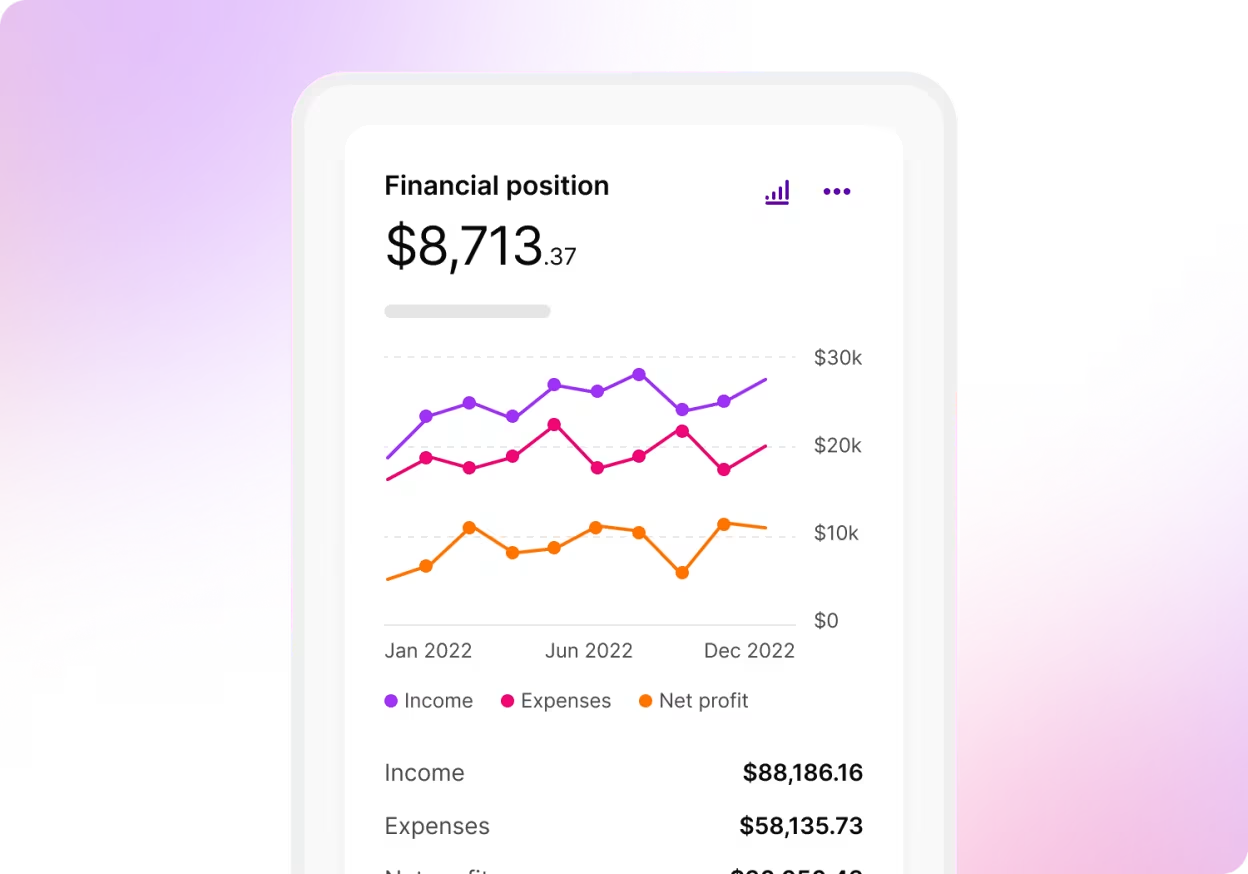

Track your income and expenses on the go to instantly see what your business needs. MYOB pulls together receipts, invoices and more so you have everything in one place.

Make an impact with centralised data

From web analytics to in-store sales purchases, access all your data from the one platform for a clear view of your customers, your cashflow and your business.

Get your apps under one roof

MYOB plays nicely with the tools you already use. Plus, we have a library of 350+ app integrations that make it easy to manage all aspects of your business.

For instance: Using Square or Shopify? Enjoy automatic syncing of all your daily sales transactions.

Move your clients to MYOB from Xero, QuickBooks, or Reckon

Moving clients’ data to MYOB Business is quick, easy, and subsidised by MYOB to make your decision even easier.

*The Digital Disconnection Challenge | MYOB Report June 2022.

The MYOB Disconnection research was conducted by SoWhat Market Research from 24th March and 17th April 2022. A nationally representative sample of 2,056 sole traders, small and medium sized businesses across Australia and New Zealand took part in the survey (1,531 in Australia; 525 in New Zealand). View report.