Unleash infinite practice potential.

Find everything you need to supercharge your accounting firm's growth, all in one place.

Your Business Un-Ltd journey starts here

Everything you need to manage a successful accounting practice – all in one cloud-based platform.

The secret to managing financials for

large accounting practices

Consolidated financials and operations – all in real-time

It’s something you probably say to clients all the time: good data is key to growing your business. Yet, so many accounting practices find themselves flying blind. The data may exist, but it tends to be scattered across various systems and peoples’ minds, not connected in a way that helps practice leaders make data-driven decisions. Instead, practice leaders often resort to relying on gut feel – not realising that this will hinder growth especially as more teams are onboarded with existing processes. Moreover, the time and energy it takes to manage disconnected finances can be standing in the way of your employees getting back to more important things like servicing clients.

Enter, ERP for accountants. The answer is MYOB Advanced Professional Services, a fully integrated practice management system with CRM, General Ledger, accounts receivables/payables, and payroll. Hosted in the cloud to link data across all teams and business divisions, practices will now be able to automate time-consuming admin tasks, and connect “work being done in the business” with the “running of the business”.

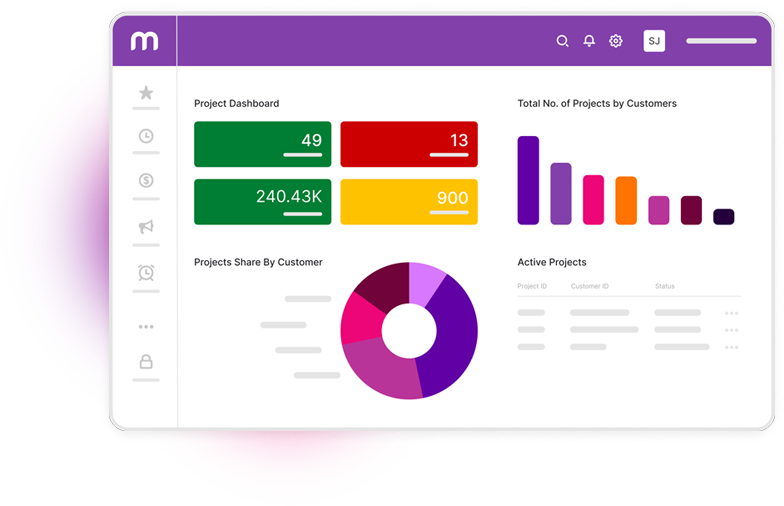

Image: MYOB Advanced Professional Services dashboard

- Consolidate financials across all entities or business divisions

Offering the ability to reimagine internal processes, operations, and trading, MYOB Advanced Professional Services is a game-changer for larger, complex accounting practices with growth ambitions.

Set up multiple concurrent pieces of client work spread across various business teams, with various WIP raised to a single business, partner, division or multiples of the same. Invoice the end client for work from multiple teams or business divisions in one go – all the while working from a single consolidated client list. The flexibility is yours – and you are no longer limited to a singular structure.

Many ambitious accounting practices have multiple service lines or entities – offices in different cities or business units operating independently. Business leaders need to be able to drill down into the performance of these entities, while also getting a top-level, consolidated view. Instead of having to hunt down data to manually consolidate and analyse in spreadsheets, MYOB Advanced Professional Services lets you do this automatically. Imagine each operating entity being able to report on its own WIP and trading, housed under the one account, automatically delivering depth of detail and consolidated financials when you need them.

MYOB Advanced Professional Services also grows as you grow – opening new lines as you absorb new companies or open more offices is a simple matter. This unlocks incredibly rich data, turning MYOB Advanced Professional into a sophisticated business management tool. You’ll be able to see, in real-time, which levers you can pull to boost efficiency, profitability and more. - Financials and operations go hand in hand

If you’ve ever wanted to know how WIP lockup and debtor lockups compare to creditor days to understand cashflow, or which business lines generate higher profit margins with a view of various subsets of clients, then MYOB Advanced Professional Services is the right fit for your firm.

For many accounting practices, accessing and compiling the data they need from different systems and spreadsheets takes so much time that many simply don’t do it. And those that do find they’re always making decisions on information that’s weeks or even months out of date. With MYOB Advanced Professional Services, all information – including financials, account receivables, payables, cash accounts updated with bankfeeds, employee payroll data, and client data from multiple entities or branches – goes into one central place. Data updated in one department is automatically reflected in another, so it can be sliced and diced in real-time and is much more reliable – no double-handling means no risk of input error.

Plus, in this way with MYOB Advanced Professional Services, you no longer need to have senior people out of the business for days or even weeks. Access to real-time data means that reporting can happen at any time – rather than end of month – and takes hours instead of days and weeks. - Use data to look forward, not back

Compiling and aligning data across your business can take time, which means that you can only look back at what the data was last month or last quarter. With MYOB Advanced Professional Services, you’ll see real-time information – from all entities or branches, local or overseas – presented on a dashboard that can be tailored to you. This gives you visibility over your entire business as it is right now, letting you make considered decisions in the moment. This is invaluable when it comes to applying for working capital, answering questions about tracking profitability, or reviewing staff performance. - Maximise staff chargeability and recoverability

Connected data through MYOB Advanced Professional Services gives you a true understanding of employee costs – since you’re selling time, this metric is critical to the health of your business. You can compare revenue against the true cost of labour like disbursements, utilisation figures and payroll – all visible from your dashboard. The key to delivering this is the system’s genuine connectivity – for example, payroll, including approved leave requests, is connected to timesheets. - Make managing finances simple

Imagine what you could do if you had the data you needed at your fingertips, without having to manually compile or manipulate it. That’s the reality for accounting practices that have already started using MYOB Advanced Professional Services. A single point of truth with built-in automation eliminates hours of busy work and removes the risk of error. Better yet, real-time data means you’re making decisions on up-to-date insights instead of looking backwards. It’s the key to making the most of your finances, boosting productivity and supercharging efficiency.

Find out more about how MYOB Advanced Professional Services can support your accounting practice’s growth journey. Book a free consultation with an MYOB expert where we’ll analyse your practice’s needs, current software and systems, plus discuss how we can help accelerate growth for your firm.