Unleash infinite practice potential.

Find everything you need to supercharge your accounting firm's growth, all in one place.

Your Business Un-Ltd journey starts here

Everything you need to manage a successful accounting practice – all in one cloud-based platform.

Improve cashflow – organisation-wide

debtor management and billing

MYOB Practice Management and MYOB Advanced Professional Services make it easy

You know how important debtor and billing management is. It ensures the lifeblood of your firm – cashflow – runs smoothly.

Integrating debtor management functionality like invoicing, receipting, debtor ageing and bad debt write-offs with your practice management is the best way to do that. This lets you keep an eye on your budgets, debtors and WIP. Without those automated systems and alerts, you’ll be stuck doing it manually, and that means wasted time, the potential for errors, rework, reputational damage and missed opportunities. You’re also more likely to be writing off bad debts.

MYOB Practice Management and MYOB Advanced Professional Services offer integrated debtor management and billing capabilities, but each comes with different specialisations – what would suit you depends on how you work and what you need from the software.

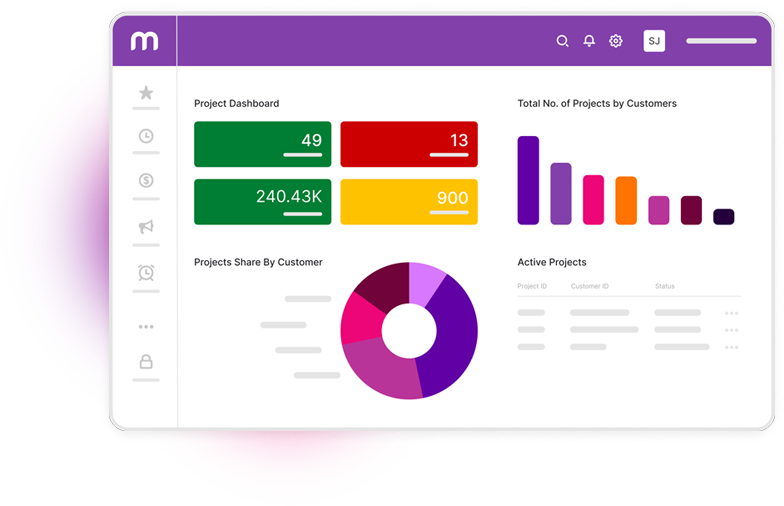

Image: MYOB Practice Management practice management dashboard

Magic billing with MYOB Practice Management

Whether billing single or complex family groups, MYOB Practice Management's ‘Billing Wizard’ will turn your WIP data directly into bills. This makes it simple to decide what to bill and what to write off. And because most of this process can be completed in bulk, billing becomes more efficient while increasing visibility and control.

Simple debtor management

MYOB Practice Management’s debtors capability is extended through integrations such as FeeSynergy. This excellent SaaS tool is hosted in the cloud, offering easy access to invoice payment options and fee financing. It can also automatically prompt customers to pay sooner, improving clients’ cashflow positions. FeeSynergy also offers a fully integrated Engagement Letters solution with Direct Debit options.

Through embedded deep links allowing you to jump between products, FeeSynergy’s integration with MYOB Practice Management is seamless. Here are the fantastic features you can expect:

- Faster cash conversion and lower debtors. Become more efficient with less need to chase payments.

- Graphical drill-down on dashboard. Quickly shift from an overview of firm, partner and management levels to a more detailed view within the same dataset.

- Preserved client cash flow. Smart workflow and email reminders put the spotlight on cashflow and help receive payments faster.

- Professional appearance. A beautiful invoice doesn’t just help bills get paid faster – it also sends a positive message about your business.

- Lowest rates and fees in the market. FeeSynergy has a great track record for minimising payment transaction costs. They also maintain the lowest interest and card surcharges for fee finance instalment payments.

- Engagement Letters and Proposals. FeeSynergy’s integrated solution enables easy APES 305 compliance.

- Free digital signatures. Available for all documents created through the FeeSynergy system including Engagement letters, fee finance agreements, direct debits, saving users thousands per year.

Make paying easier

Giving your debtors plenty of payment options makes them more likely to pay straight away. MYOB Practice Management offers an integrated credit card gateway, direct debits and other payment arrangements. These include:

- Fee finance

Get paid in full by FeeSynergy – no more waiting for late payers. The debtors then repay FeeSynergy over a selected time frame. You get faster cash conversion, a lower rate of debtors and the lowest interest rates in the market. - Card gateway

Much quicker than manual processing, a card gateway is PCI-compliant and embedded in your website. The intelligent system automatically displays outstanding invoices for your clients to pay with links on practice management invoices, reminders and engagement letters. - Direct debits with free digital signatures

This is the only bank approved direct-debit signing solution, and providing the fastest settlements in the industry. With standing direct debit authorities saved in your FeeSynergy system, no more paper, scanning or email is needed. Automated task creation is there to follow up on failed payments, and email reminders are sent before debits come out.

Spot potential bad payers early

Gain easy access to Equifax credit scores, trends and reports. With FeeSynergy’s credit insights module, you can create advanced reports highlighting potential clients who might be late payers. By adding this extra filter, you can identify ‘at risk’ clients and take steps to mitigate any impact on your business. Apart from mitigating risk, this is an extremely powerful business advisory tool that will generate additional revenue.

Image: MYOB Advanced Professional Services dashboard

MYOB Advanced Professional Services for billing

Where MYOB Practice Management uses integration with other systems, most functionality is baked right into MYOB Advanced Professional Services. That means you still get all the above features, plus:- Finances stay reconciled

Take away hours of painful admin with built-in bank feeds. MYOB Advanced Professional Services keeps multiple cash and trading bank accounts reconciled, so you can get your receipting done fast. - A single view of WIP

Speed up payments, streamline tax filings, automate accounts receivable and send invoices from anywhere. With WIP data on a single screen, you can quickly identify opportunities and enable faster billing. - Richer data for clients

Integrate with General Ledger finance integrations. You can deliver richer data by looking at transactions alongside revenue and account balances. - Real-time debtor, cashflow and WIP in general ledger

MYOB Advanced Professional Services also lets you see real-time cashflow, WIP, and debtor information in the general ledger – you can even see bad debts right there in your balance sheet.

MYOB Advanced Professional Services for debtor management

As time goes on, you'll get your share of late-paying customers. Some are just disorganised, while others may have cash problems of their own. Either way, you have to manage them carefully to get your money.- Better insight into clients

Regular assessment of your clients will help identify potential risks early on. You can build in more checks before you start work and remedy issues before they cause major problems. It will also let you see when it would be worth negotiating different credit terms or billing arrangements across your client base. - More oversight over debtors

You can avoid too much liability with clarity of information and better analytics. Instead, strike the right balance of time, cost, quality and debtor risk. - A bird’s-eye view from debtors to management

Optimise your operations using built-in invoicing, bank feeds and debtor tracking. With an ability to dissect debtor lock-up or balances by partner, clients, division and service lines, your firm will avoid accruing too much outstanding debt.

Get paid sooner

From simple invoicing to comprehensive billing and debtor management, MYOB Practice Management and MYOB Advanced Professional Services automate manual tasks and keep your cashflow healthy. With better data insights, more payment options, and streamlined integration, you'll soon forget the days of bad debtors and late payments.

To learn more about how MYOB Practice Management and MYOB Advanced Professional Services can improve your billing and debtor management, get in touch with MYOB today.