- Multiple layers of always-on security

- Secure payment options made simple

- MYOB Verified badge

- End-to-end secure invoice distribution

Update: From mid-May we will test secure invoicing with a small number of new MYOB Business customers. Learn more.

Secure invoicing is rolling out in 2025 to customers who send invoices on MYOB subscription plans from MYOB Business Lite through to AccountRight Premier. It adds multiple layers of security for your clients' businesses, plus automation features designed to help them save time and accelerate cashflow.

Cybercrime costs Australian small businesses an estimated $300 million every year, and invoicing scams targeting small businesses are increasing in frequency, sophistication and impact. We’re upgrading the invoice experience to enhance the security of our platform for the benefit of everyone who uses it, including our valued partners, clients and customers, and the customers who pay their invoices. We want to work together to educate clients on the risks of invoice fraud and other scams, and support them in adopting business verification as a means to building a safer payment ecosystem.

Why we’re requiring clients to verify

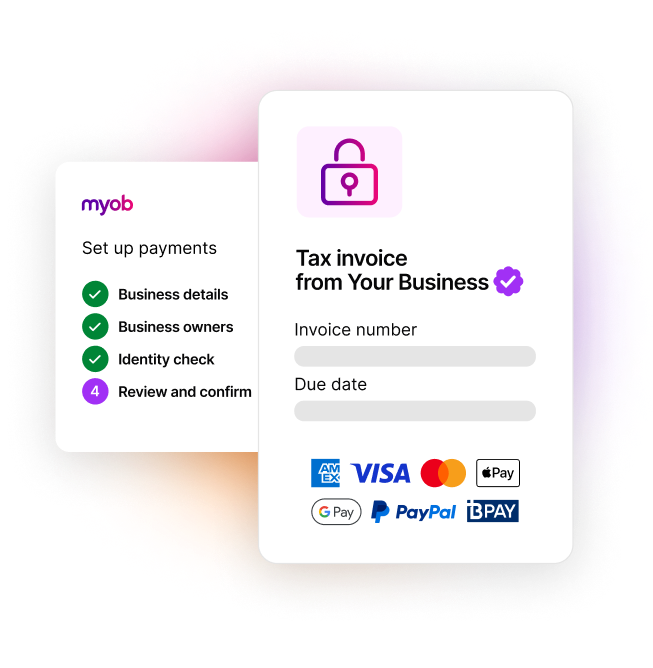

Verified businesses play a critical role in preventing fraud. Our verification process is intentionally rigorous, requiring individual, business and bank account verification. This multi-step process is completed using industry-standard, secure methods, and has been designed to deter cyber criminals from attempting to infiltrate the process. Cyber security is a shared responsibility that requires vigilance from everyone, at every level. By becoming an MYOB Verified Business, clients help safeguard the entire system. A network of verified businesses means fewer risks and safer transactions, so clients can invoice with confidence, and customers can pay knowing they’re interacting with a trusted business.

Secure invoicing adds multiple layers of security for verified businesses, including:

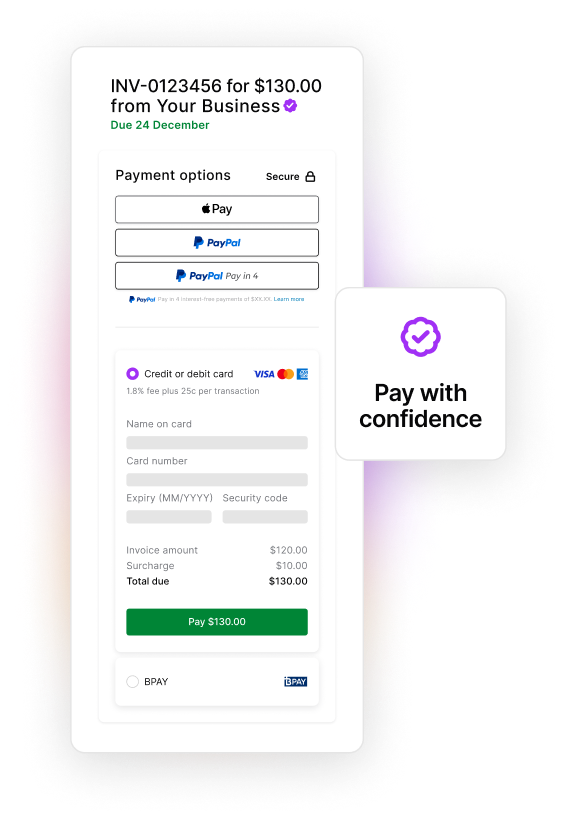

- Additional secure payment options (including Visa, Mastercard, AMEX, Apple Pay, Google Pay and PayPal), with an option to pass fees* on to paying customers so your clients aren’t left out of pocket. We've included more information on these default settings below.

- Always-on fraud monitoring for transactions and payment activity using industry standard protocols and supported by daily monitoring from our fraud team.

- MYOB Verified badge on all secure invoices, giving customers peace of mind when they’re paying a verified business in our secure environment.

- End-to-end secure invoice distribution, including use of the MYOB system to send invoices with secure links via email, copy link, and the additional option of SMS, so clients can easily text invoices with secure links on the go.

- Sync bank feeds for auto-reconciliation of payments and fees, reducing manual errors and data entry time.

- Set up smart reminders for chasing overdue payments that automatically turn off as soon as an invoice is paid.

- Get paid for multiple invoices in a single transaction with the bulk invoice view, for easy visibility of all outstanding payments owed by a customer.

- Easily share invoices via SMS, so clients can text invoices to paying customers on the go.

- We're upgrading clients who use invoicing on MYOB Business subscription plans from Lite through to AccountRight Premier.

Your clients will need to complete our one-time business verification process to receive the upgrade and ensure continued use of all invoicing features, specifically the ability to share and email invoices using the secure MYOB system.

- The primary business contact will receive an email from MYOB at least 30 days before they are required to complete the business verification process. And they’ll receive periodic reminders throughout.

The upgrades will roll out gradually throughout the year. This staggered approach ensures we can provide appropriate support throughout, so you may have clients that are upgraded at different times.

Why is this change happening?

Cybercrime costs Australian small businesses an estimated $300 million every year, and invoicing scams targeting small businesses are increasing in frequency, sophistication and impact. We’re upgrading the invoice experience to enhance the security of our platform for the benefit of everyone who uses it, including our valued partners, clients and customers, and the customers who pay their invoices. We want to work together to educate clients on the risks of invoice fraud and other scams, and support them in adopting business verification as a means to building a safer payment ecosystem.

MYOB has been dedicated to helping SMEs start, survive, and succeed for more than 30 years, and we understand that falling victim to a scam can have very real consequences. The secure invoicing upgrade is a necessary change to deliver robust standards of security, to combat growing threats of financial fraud and allow you and your clients to do business safely and securely.

What is invoice fraud, or false billing?

False billing was the most reported scam by small businesses in 2023. It occurs when cyber criminals impersonate parties involved in transactions with the goal of redirecting funds. Verification provides assurances that invoices are linked to a legitimate business that matches the ABN record, and the bank account associated with the MYOB file. If cyber criminals were to gain access to accounts and attempt to change the settlement account used for secure payments, they would be forced to re-verify the account—adding an extra layer of protection.

Why business verification?

Verified businesses play a critical role in preventing fraud. Our verification process is intentionally rigorous, requiring individual, business and bank account verification. This multi-step process is completed using industry-standard, secure methods, and has been designed to deter cyber criminals from attempting to infiltrate the process.

Cyber security is a shared responsibility that requires vigilance from everyone, at every level. By becoming an MYOB Verified Business, clients help safeguard the entire system. A network of verified businesses means fewer risks and safer transactions, so clients can invoice with confidence, and customers can pay knowing they’re interacting with a trusted business.

Which clients will be upgraded?

Invoicing clients on MYOB subscription plans from Lite through to AccountRight Premier, who haven’t previously completed the business verification process.

Subscription plans being upgraded:

- MYOB Business Lite

- MYOB Business Pro

- MYOB Business AccountRight Basics

- MYOB Business AccountRight Standard

- MYOB Business AccountRight Plus

- MYOB Business AccountRight Premier

When is this upgrade happening?

The secure invoicing upgrades commenced in March 2025 and will roll out gradually over the year. This staggered approach ensures we can provide appropriate support throughout the verification process, and as a result, you may have clients that are upgraded at different times.

How will clients know when it’s time to upgrade?

The primary business contact will receive an email from MYOB at least 30 days before they are required to complete the process. Your clients don’t have to take action immediately, but they can get started right away if they like.

If you are set up as the primary contact for a client business, you will receive the notification directly.

When it’s time to upgrade, we’ll send another email outlining their specific deadlines. We’ll also send periodic reminders throughout the process.

What do my clients need to do?

- Verification of identities of all ultimate beneficial owners, typically any individual with 25% or more ownership or voting rights for a company.

- Verification of the bank account associated with the business. For additional security for both clients and paying customers, any request to change bank accounts in the future will trigger a repeat of the bank account verification process.

- We also collect other basic information including a credit score check. This is not a bureau enquiry, and will not be noted on credit history reports.

- Specific documentation requirements will vary depending on business type and structure. Please refer to this support page for more information broken down by business type.

How long does business verification take?

This depends on the structure of your clients business. If they’re a sole trader and have all of their identity documents ready to go, the verification process should take approximately 15-20 minutes. For more complex entity types, it may take longer. They may be required to provide additional documents, including identity documents for senior managing officials and/or beneficial owners.

Once your clients have completed their business verification (including required documents), the process is typically finalised within a few business days. However, we are currently experiencing a high volume of verification requests. If you have any questions about the status of your business verification, please log a Financial Services request in My Account.

Who can complete business verification?

Any user with access to the file can start the verification process.

Why are secure payment options included in the secure invoicing upgrade?

As we develop security features that meet the evolving needs of our diverse customer base, the ability to offer payments is an essential component in a secure ecosystem.

Invoice fraud typically targets bank account information on static invoices. By verifying the bank account connected to their MYOB file and adding a secure payment link to their invoices, clients benefit from additional layers of protection from bad actors who may gain access to their email or accounts.

We recommend offering these payment options to provide the most secure customer experience, however, after completing the verification process, customers can turn these methods off if they prefer to do so.

What are the invoice payment default settings?

Clients can manage settings to suit their business needs. Here's what you need to know:

- Secure payment methods (excluding BPAY) are enabled by default. Fees apply* if customers choose to pay using a secure method. Unless clients change the default settings, a surcharge will be automatically passed on to paying customers, so your clients don’t pay unexpected fees.

- Clients can choose to cover surcharges on behalf of their customers, or toggle payments on/off if they prefer.

- Default settings apply to invoices and recurring invoice templates created prior to verification.

- Settings can be adjusted on a per-invoice basis, in recurring invoice templates, and globally by default.

- If changes are made to global defaults, they will apply to any new invoices and new recurring templates created. Changes will not override settings on existing invoices and templates.

Do my clients have to pay transaction fees on online payments?

Your clients can choose whether to cover transaction fees themselves or pass them on to their customers. Fees are automatically set to be passed on to their customers unless they turn off surcharging, or turn on BPAY. After completing the upgrade process, they can adjust fee settings under Online Payments settings, or apply settings on a per-invoice level.

What are the transaction fees?

$0.25 per transaction + 1.8% of total invoice (inc. GST).

What happens if my client doesn’t complete the business verification process in time?

The secure distribution system is only available to verified businesses. If verification is not completed by specified deadlines, functionality for sharing and distributing invoices may be restricted. Specifically, the email, copy link and SMS options for invoice sharing will be disabled, and invoices will need to be downloaded and emailed manually until the business has been verified.

What happens if my client decides not to upgrade to secure invoicing?

They can continue to use invoicing functionality if they choose not to upgrade, however, they won’t be able to share invoices with their customers via the secure MYOB system. Specifically, this means you will not be able to share invoices using the email, copy link or SMS options available within the platform.

Your clients will however be able to download the invoice and directly send it to their customers.

Upgraded clients gain access to the full suite of security features, and we recommend upgrading if they’d like to offer their customers a secure end-to-end invoicing experience.

Can my client turn off online payments once upgraded?

Following the verification process, customers can turn secure payments off if they prefer to.

Can my clients continue to receive payments through my preferred method after completing the upgrade process?

Yes, they can. We'll provide detailed information on their new settings, and how to adjust them to suit their preferences. Please note that invoices without secure payment methods will not include the MYOB Verified badge.

Can my client upgrade to secure invoicing before they receive a notification?

Yes, they can upgrade to secure invoicing early by completing their business verification here.

What is the “MYOB Verified” badge?

Our research shows that 85% of consumers look for indicators that a new business or service provider is trustworthy, particularly when clicking on links or making payments online. The MYOB Verified badge is exclusively available to customers who complete the verification process, and will be displayed to your customers to signify when they are interacting with you in our secure environment.

My client has already verified their business when setting up Online Payments. Will they have to verify again for secure invoicing?

No, they don’t need to complete the business verification process again. If their business has already been verified, no further action is required.

My client would like an extension on their upgrade, how do they request this?

For verification support during the upgrade process, or to request an extension on functionality restrictions, you can log a Financial Services request in My Account.

*Applications subject to approval. Fees apply (inc. GST): $0.25 per transaction + 1.8% of total invoice. Fees will be automatically passed to your customers unless you turn off surcharging. Payments accepted via Visa, Mastercard, AMEX, Apple Pay, Google Pay and PayPal. You can also choose to enable BPAY, but you cannot pass a surcharge on to customers using this method. View terms and conditions.

s.