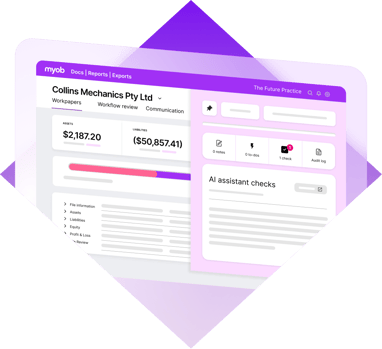

MYOB Practice Compliance

/Project%20Freyja/LP_H_UI_Freja_960%20(2).png?width=800&height=420&name=LP_H_UI_Freja_960%20(2).png)

Introducing compliance in the cloud

Client Accounting streamlines how accountants collect, prepare, and deliver financial requirements for greater efficiency. Standardise workpapers and financial statements with consistency and quality, supported by powerful AI Assistants.

Now, complete workflows in the cloud for clients with company and trust structures. Plus, save time with AI-assisted ledger mapping, transforming fragmented client data into a single, streamlined chart of accounts.

/CustomInvoices.png?width=100&height=100&name=CustomInvoices.png)

Connected and automated dataflow

Reduce manual handling and improve accuracy with live data flowing directly from your clients’ software into online workpapers and financial statements.

/Support.png?width=100&height=100&name=Support.png)

Collaboration and Visibility

Simplify the review process with built-in messaging tools, progress tracking, side-by-side comparisons and audit trails. Creating a smooth review process for managers.

/Cashflow.png?width=100&height=100&name=Cashflow.png)

Powerful portfolio-wide data analysis

Unlock client engagement opportunities with access to your entire client portfolio to identify trends and set up automated alerts.

/Complexity.png?width=100&height=100&name=Complexity.png)

AI Assistant for account mapping

Save time with AI-Assisted mapping from any client ledger to a standardised chart of accounts, turning inconsistent client data into a single, streamlined format.

WEBINAR: Introducing all-new Client Accounting

Thursday, 28 August - 12pm AEST

Join us for an exclusive webinar introducing our all-new Client Accounting module, purpose-built for modern Australian practices seeking smarter, more connected compliance workflows.

Our specialists will show you how you could accelerate your core compliance tasks, elevate team efficiency, and deliver a consistent, professional client experience—all within one unified cloud platform.